Not too long ago, retirement planning was built on the concept of a three-legged stool. One, a pension, negotiated by you and promised by your employer. Two, your own investments, saved by you and supported by an ever-growing economy. Three, Social Security, provided by you and your employer and mandated by your government.

With this secure and sturdy stool in place, a solid retirement plan was once likely, if not probable. For many today, retirement security is based not on a concept of a stool, but rather a pogo stick, where Social Security plays a huge role for those who struggle to save and invest.

Given its importance, the next Money Series event will delve into Social Security; how the program works and the rules you should understand to get the most out of it.

To highlight Social Security’s impact on our lives, a few facts speak volumes.

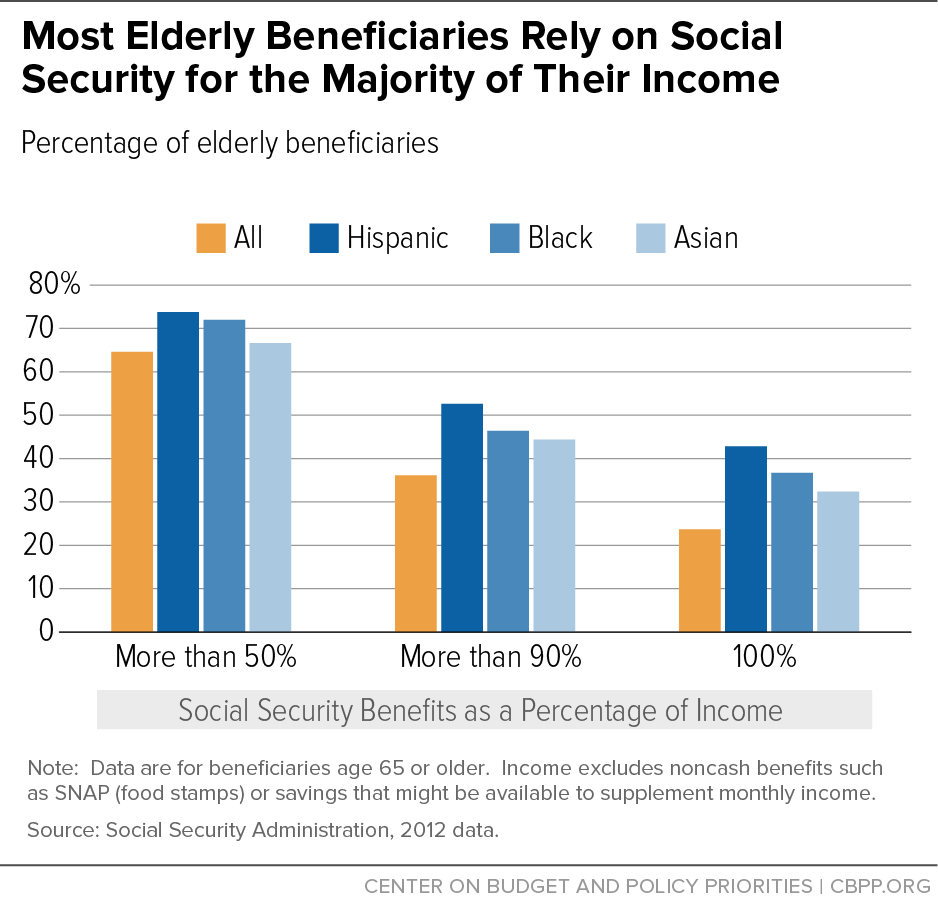

Approximately 60 million people receive almost $1 trillion in benefits every year. On average, the program provides about one third of household income for the elderly. Yet, even those statistics don’t properly paint the full picture.

Digging deeper, about half of all retired married couples and three out of four retired single people receive more than half of their income from Social Security. Shockingly, almost half of retired singles rely on Social Security for over 90% of their income.

Social Security is a big deal. Even so, its various rules and options remain a mystery to most. It literally pays to know them better.

Far too many fail to realize the advantages of simply waiting to file for benefits. As a result, millions leave billions of dollars on the table by choosing to file at their earliest possible age of eligibility. In fact, just less than half file for benefits at age 62. Astonishingly, waiting until age 70 to file for benefits results in nearly 80% more per month.

In an age of constant medical advancements, longevity can be both a friend and foe. Earning Social Security’s delayed-retirement credits, earned by waiting to file for as long as possible, is just one tool tilting things in your favor.

For married couples, it’s important to understand that lower-earning spouses may be entitled to receive additional benefits – called, spousal benefits – in exchange for supporting the careers of their higher-earning spouse and/or choosing to raise the children.

Many people also fail to understand that even after a divorce or the death of a spouse they are entitled to benefits connected to their former married status. Spousal benefits for divorced retirees and survivor benefits are yet another wrinkle that deserves a deeper education.

Finally, since April is just around the corner, it’s also important to understand how your Social Security benefits are taxed. From the limits on what you are allowed to earn when you are under age 66 to the amount of income allowed before Social Security starts to tax away your benefits, various strategies do exist to help you minimize the taxman’s bite.

To hear more on Social Security’s rules and options, join me on Wednesday, Feb 15th at 6:30pm for the Front Street Foundation’s Money Series held in the McGuire Room at the Traverse Area District Library. Click the Register button below or call (231) 714-6459 to register.

Image Credit: Center on Budget and Policy Priorities | CBPP.ORG